The Bank of Canada has officially lowered its policy interest rate to 2.25%, marking a major step toward returning monetary policy to a neutral stance as inflation settles close to its 2% target.

This move is great news for Canadians — especially those in the Victoria real estate market — as borrowing costs continue to ease and mortgage rates reach their lowest levels in years. Whether you’re planning to buy, sell, or refinance, now may be the perfect time to make your next move.

The Bank of Canada’s Latest Rate Decision

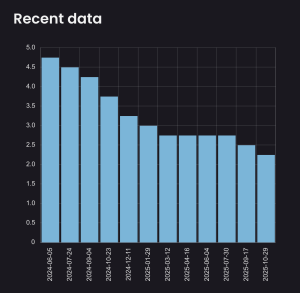

On October 29, 2025, the Bank of Canada announced it was cutting its overnight lending rate to 2.25%, a 25 basis point reduction.

In its official statement, the Bank said that “monetary policy no longer needs to be restrictive” as inflation has moved sustainably toward the 2% target. With price pressures easing and economic growth stabilizing, lower rates are now supporting consumer confidence and market activity across Canada.

For Victoria’s housing market, this means improved affordability, stronger buyer interest, and a healthier pace of home sales heading into the end of the year.

Mortgage Rates Are Also Trending Lower

Alongside the Bank of Canada’s rate drop, mortgage lenders have followed suit with more competitive borrowing options. According to Ratehub.ca, the best 5-year fixed mortgage rates in Canada have now fallen close to 4%, down significantly from the highs seen in 2023 and early 2024.

This decline in mortgage rates is a game changer for both first-time buyers and move-up homeowners. Lower fixed rates mean:

-

Reduced monthly mortgage payments

-

Greater purchasing power

-

Easier mortgage qualification

-

Increased confidence in long-term affordability

Combined with the Bank of Canada’s rate cut, these trends are making home ownership in Victoria more accessible than it has been in years.

What the Rate Drop Means for Home Buyers in Victoria

If you’ve been waiting for the right time to buy, the current conditions are as close to ideal as they come.

-

Affordability is improving: Lower rates mean more manageable payments.

-

Inventory levels are healthy: There’s a good selection of condos, townhomes, and detached properties available across Greater Victoria.

-

Buyer confidence is returning: Stabilizing prices and easier financing encourage movement.

Whether you’re purchasing your first condo downtown or a family home in Saanich, these conditions allow you to buy strategically — with time, choice, and favorable financing on your side.

What the Rate Drop Means for Home Sellers

If you’re planning to sell, this is also a pivotal opportunity. When borrowing costs fall, buyer activity typically rises, creating stronger demand and renewed energy in the market.

Here’s why sellers can benefit from today’s conditions:

-

More qualified buyers are actively searching.

-

Balanced inventory means healthy competition without oversupply.

-

Home values remain stable and may appreciate as demand increases.

For the best results, sellers should focus on presentation and pricing. A well-marketed property that reflects today’s fair market value can attract motivated buyers quickly in this environment.

The Victoria Market Outlook for Late 2025

Victoria’s real estate market is known for its stability, and the latest data shows that trend continuing. Inventory has increased year-over-year, giving buyers more choice, while prices have remained relatively steady across most neighborhoods.

With the key interest rate now at 2.25% and mortgage rates at 3.79%, experts expect a gentle rebound in buyer demand through the winter months. This means:

-

More transactions as affordability improves.

-

Steady home prices in core areas like Oak Bay, Fairfield, and Saanich East.

-

Renewed activity in the condo and townhome segments, which benefit most from lower financing costs.

The takeaway: Victoria is entering a period of measured, sustainable growth — good news for both buyers and sellers.

Why Now Is the Right Time to Act

Periods of low interest and mortgage rates don’t last forever. As the economy stabilizes, rates could begin to rise again in 2026, meaning now is the time to move confidently.

-

For buyers: Lock in a low rate and take advantage of increased choice.

-

For sellers: Benefit from the resurgence in buyer demand and steady home values.

-

For investors: Lower borrowing costs improve ROI and long-term equity growth.

Whether you’re purchasing, selling, or refinancing, the current conditions create a rare opportunity to act strategically in Victoria’s balanced housing market.

Work With a Local Expert

Navigating these changes requires deep local insight. Brad Maclaren, one of the top realtors in Victoria BC, has guided clients through every kind of market with skill and professionalism. His expertise ensures buyers and sellers make the most of today’s conditions — from strategic pricing to expert negotiation.

Contact Brad today to schedule a personalized market consultation and discover how the 2.25% interest rate and low mortgage environment can work in your favor.